Embark on a journey through the realm of Affordable Life Insurance Plans for Retirees in 2025, where we unravel the intricacies of securing the best coverage for your golden years.

Delve into the nuances of different types of plans, strategies to find the most cost-effective options, and key considerations to keep in mind when selecting the perfect life insurance plan.

Factors influencing the cost of life insurance for retirees in 2025

When it comes to determining the cost of life insurance for retirees in 2025, several factors play a crucial role. These factors include age, health conditions, and lifestyle choices, all of which can significantly impact insurance premiums.

Age

Age is a key factor that influences the cost of life insurance for retirees. Generally, the older you are, the higher your premiums are likely to be. This is because older individuals are considered to be at a higher risk of health issues and mortality, leading insurance companies to charge higher premiums to mitigate this risk.

Health Conditions

Health conditions also play a significant role in determining the cost of life insurance for retirees. Individuals with pre-existing health conditions may face higher premiums or even be denied coverage altogether. Insurance companies assess the health risks associated with each individual and adjust premiums accordingly.

Lifestyle Choices

Lifestyle choices, such as smoking or engaging in risky hobbies, can impact insurance rates for retirees. Smoking, for example, is linked to various health issues, leading to higher premiums for smokers compared to non-smokers. Similarly, engaging in hazardous activities like skydiving or racing can also result in increased insurance costs due to the higher risk involved.

Types of life insurance plans suitable for retirees in 2025

Life insurance is an essential financial tool for retirees to ensure their loved ones are taken care of after they pass away. In 2025, there are several types of life insurance plans that are particularly suitable for retirees, each with its own set of features and benefits.

Term life insurance vs. whole life insurance for retirees

Term life insurance is a type of life insurance that provides coverage for a specific period, usually 10, 20, or 30 years. It offers a death benefit to the beneficiaries if the policyholder passes away during the term. On the other hand, whole life insurance provides coverage for the entire life of the policyholder and includes a cash value component that grows over time.

- Term life insurance is generally more affordable than whole life insurance, making it a popular choice for retirees on a budget.

- Whole life insurance offers lifelong coverage and a savings component that can be used for retirement income or other financial needs in retirement.

- Retirees who are looking for temporary coverage and lower premiums may opt for term life insurance, while those seeking permanent coverage and an investment component may prefer whole life insurance.

Universal life insurance for retirees

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefits. Unlike whole life insurance, universal life insurance allows policyholders to adjust their premiums and death benefits over time, making it a versatile option for retirees.

Universal life insurance provides a cash value component that earns interest based on current market rates, offering potential for growth over time.

- Retirees who value flexibility in their life insurance coverage and premium payments may find universal life insurance to be a suitable option.

- With universal life insurance, retirees can adjust their coverage as their financial needs change in retirement, providing a level of adaptability that other types of insurance may not offer.

Benefits of final expense insurance for retirees in 2025

Final expense insurance, also known as burial insurance or funeral insurance, is a type of whole life insurance designed to cover end-of-life expenses, such as funeral costs, medical bills, and other debts

- Final expense insurance typically has lower coverage amounts and premiums compared to traditional life insurance policies, making it a more affordable option for retirees.

- By securing final expense insurance, retirees can ensure that their end-of-life expenses are covered, relieving their family members of financial responsibilities during a difficult time.

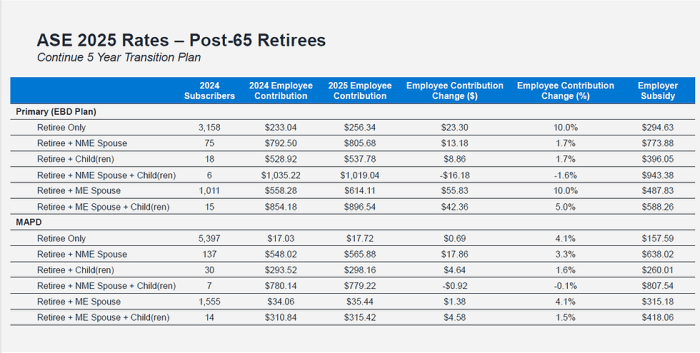

Strategies to find affordable life insurance plans for retirees in 2025

Finding affordable life insurance plans for retirees in 2025 can be a crucial step in securing financial stability during retirement. Here are some strategies to help retirees find cost-effective life insurance options:

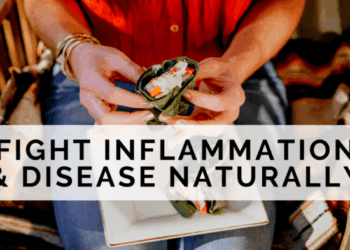

Leveraging Group Life Insurance Options for Retirees

Group life insurance plans offered through professional organizations, alumni groups, or other associations can often provide more affordable rates compared to individual policies. Retirees should explore these group options to see if they can take advantage of discounted rates and comprehensive coverage.

Shopping Around and Comparing Quotes

Retirees should not settle for the first life insurance quote they receive. It's essential to shop around and compare quotes from different insurers to find the most competitive rates. By comparing multiple offers, retirees can ensure they are getting the best value for their money and tailor the coverage to their specific needs.

Maintaining a Healthy Lifestyle

Maintaining a healthy lifestyle can positively impact life insurance costs for retirees. Insurers often take into account factors like overall health, medical history, and lifestyle habits when determining premiums. Retirees who prioritize their health by staying active, eating well, and avoiding harmful habits like smoking can potentially lower their life insurance costs and qualify for better rates.

Key considerations when choosing a life insurance plan for retirees in 2025

When selecting a life insurance plan as a retiree in 2025, there are several key factors to consider to ensure you make the right choice for your financial security and peace of mind.

Significance of coverage amount

One of the most crucial considerations when choosing a life insurance plan for retirees is the coverage amount. It is essential to assess your financial needs and obligations to determine the right amount of coverage that will provide adequate protection for your loved ones in case of your passing.

Importance of evaluating the financial stability of an insurance company

Before deciding on a life insurance plan, retirees should thoroughly evaluate the financial stability of the insurance company offering the policy. Ensuring that the insurer is financially sound and has a good reputation will give you confidence that your beneficiaries will receive the benefits promised under the policy.

Role of beneficiaries and policy customization

Another important factor to consider when choosing a life insurance plan for retirees is the role of beneficiaries and the ability to customize the policy to meet your specific needs. Designating the right beneficiaries and customizing the policy features can help tailor the coverage to align with your unique circumstances and ensure that your loved ones are adequately protected.

Conclusion

As we conclude our exploration of Affordable Life Insurance Plans for Retirees in 2025, remember that securing your financial future is a vital step towards ensuring peace of mind and protection for your loved ones.

FAQ Insights

How does age impact life insurance premiums for retirees?

Age plays a significant role in determining life insurance premiums for retirees, with older individuals generally facing higher costs due to increased risk.

What are the benefits of final expense insurance for retirees in 2025?

Final expense insurance provides coverage specifically for end-of-life expenses such as funeral costs, ensuring that retirees have a financial safety net in place for their loved ones.

How can maintaining a healthy lifestyle help reduce life insurance costs for retirees?

Maintaining a healthy lifestyle, including regular exercise and a balanced diet, can lead to lower life insurance costs for retirees by minimizing health risks and demonstrating a lower likelihood of filing claims.

![Natural Remedies to Treat Crohn's and Colitis [Slideshow]](https://medic.infogarut.id/wp-content/uploads/2025/12/Best-Treatment-for-Crohns-Disease-Expert-Insights-120x86.jpg)