Life Insurance Options for People Over 50 in the Digital Age sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a focus on the importance of life insurance for individuals over 50 in today's digital era.

Explore the impact of the digital age on accessing and purchasing life insurance, as well as the key factors to consider when navigating through various online life insurance options.

Introduction to Life Insurance Options for People Over 50 in the Digital Age

Life insurance plays a crucial role in providing financial security and peace of mind for individuals over 50, ensuring their loved ones are protected in the event of unforeseen circumstances. In today's digital age, the way people access and purchase life insurance has been revolutionized, offering convenience and efficiency like never before.

The Impact of the Digital Age on Life Insurance

The digital age has transformed the life insurance industry, making it easier for individuals over 50 to explore and compare various life insurance options online. With just a few clicks, they can now research different policies, obtain quotes, and even purchase coverage from the comfort of their homes.

Key Factors to Consider When Exploring Life Insurance Options Online

- Policy Coverage: Ensure the policy provides adequate coverage for your specific needs and financial obligations.

- Premium Costs: Compare premium rates from different insurers to find a policy that fits your budget.

- Policy Features: Look for additional features such as riders or benefits that can enhance your coverage.

- Financial Strength of the Insurer: Choose a reputable insurer with a strong financial rating to ensure they can fulfill their obligations.

- Customer Reviews: Consider feedback from other policyholders to gauge the insurer's customer service and claims processing efficiency.

Types of Life Insurance Policies Suitable for Individuals Over 50

Life insurance policies for individuals over 50 come in various types, each with its own features and benefits. It is important to understand the differences between these policies to choose the one that best fits your needs.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. This type of policy offers a death benefit to your beneficiaries if you pass away during the term. Term life insurance is generally more affordable compared to other types of life insurance, making it a suitable option for individuals over 50 who may be looking for temporary coverage.

Whole Life Insurance

Whole life insurance offers lifelong coverage and includes a cash value component that grows over time. Premiums for whole life insurance policies are typically higher than term life insurance but remain level throughout the policyholder's life. This type of policy can be beneficial for individuals over 50 who seek coverage for their entire life and want to build cash value over time.

Universal Life Insurance

Universal life insurance is a flexible policy that allows policyholders to adjust their premiums and death benefits. This type of policy combines a death benefit with a cash value component that earns interest over time. Universal life insurance provides more flexibility compared to whole life insurance, making it a suitable option for individuals over 50 who want the ability to adjust their coverage as their needs change.

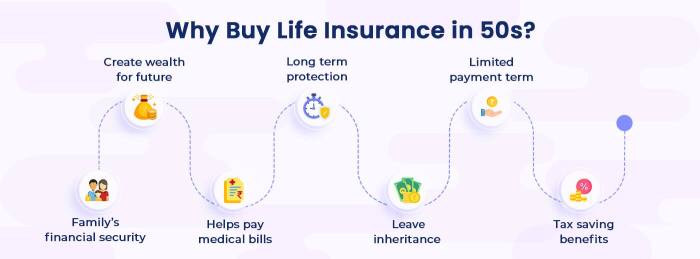

Benefits of Life Insurance for Individuals Over 50

Life insurance for individuals over 50 comes with several advantages that can provide financial security and peace of mind for both the policyholder and their loved ones.

Funeral Expenses and Outstanding Debts Coverage

- Life insurance can help cover funeral expenses, which can be a significant financial burden on family members.

- With a life insurance policy, any outstanding debts, such as mortgage payments or medical bills, can be paid off, relieving loved ones of financial stress.

Financial Security for Loved Ones

- Life insurance provides a tax-free lump sum payment to beneficiaries upon the policyholder's death, ensuring that loved ones are financially secure in the event of unexpected circumstances.

- This financial support can help cover daily living expenses, education costs, or any other financial needs that may arise.

Tax Implications and Estate Planning Benefits

- Life insurance proceeds are typically not subject to income tax, providing a tax-efficient way to pass on wealth to beneficiaries.

- Life insurance can also be used as a tool for estate planning, helping individuals protect and distribute their assets according to their wishes.

Factors to Consider When Choosing a Life Insurance Policy Online

When selecting a life insurance policy online, individuals over 50 must carefully consider various factors to ensure they make the right choice. These factors can significantly impact the coverage, premiums, and overall benefits of the policy.

Coverage Amount

- It is essential to determine the appropriate coverage amount based on your financial obligations, such as outstanding debts, mortgage, and future expenses.

- Consider factors like inflation and potential changes in your financial situation when deciding on the coverage amount.

- Ensure the coverage is sufficient to provide financial security to your beneficiaries in the event of your passing.

Premiums

- Compare premium rates from different online insurance providers to find a policy that fits your budget.

- Consider the frequency of premium payments (monthly, quarterly, annually) and choose a payment schedule that works for you.

- Beware of extremely low premiums that may indicate limited coverage or hidden fees.

Policy Duration

- Determine the length of the policy based on your financial goals and obligations.

- Consider whether you need coverage for a specific period or lifelong protection.

- Be aware of any limitations or restrictions that may apply to the policy duration.

Riders

- Explore optional riders that can enhance your coverage, such as critical illness, accidental death, or long-term care riders.

- Understand the impact of adding riders on your premiums and overall benefits.

- Choose riders that align with your specific needs and provide additional protection.

Evaluating Credibility of Online Insurance Providers

- Check the insurance provider's reputation, ratings, and reviews from other customers.

- Verify the company's licensing and accreditation to ensure they are legitimate and authorized to offer insurance products.

- Avoid providers with a history of complaints, fraud allegations, or unethical practices.

Comparing Quotes Effectively

- Request quotes from multiple insurance providers to compare coverage options and premiums.

- Consider additional benefits, discounts, and incentives offered by each provider.

- Use online comparison tools to streamline the quote comparison process and make an informed decision.

Concluding Remarks

In conclusion, Life Insurance Options for People Over 50 in the Digital Age sheds light on the significance of securing life insurance for individuals in this age group, highlighting the benefits, types of policies, and essential considerations when choosing coverage online.

Expert Answers

What are the main types of life insurance policies suitable for individuals over 50?

Individuals over 50 can opt for term life, whole life, or universal life insurance policies depending on their needs and financial goals. Each type offers unique features and benefits tailored to different situations.

How does life insurance help cover expenses for individuals over 50?

Life insurance can assist in covering funeral expenses, outstanding debts, and provide financial security for loved ones left behind. It offers peace of mind and ensures that financial burdens are minimized during a difficult time.

What factors should individuals consider when choosing a life insurance policy online?

When selecting a life insurance policy online, individuals over 50 should carefully evaluate coverage amount, premiums, policy duration, and the inclusion of riders. It's crucial to verify the credibility of online insurance providers and compare quotes effectively to make an informed decision.

![Natural Remedies to Treat Crohn's and Colitis [Slideshow]](https://medic.infogarut.id/wp-content/uploads/2025/12/Best-Treatment-for-Crohns-Disease-Expert-Insights-75x75.jpg)

![Natural Remedies to Treat Crohn's and Colitis [Slideshow]](https://medic.infogarut.id/wp-content/uploads/2025/12/Best-Treatment-for-Crohns-Disease-Expert-Insights-120x86.jpg)